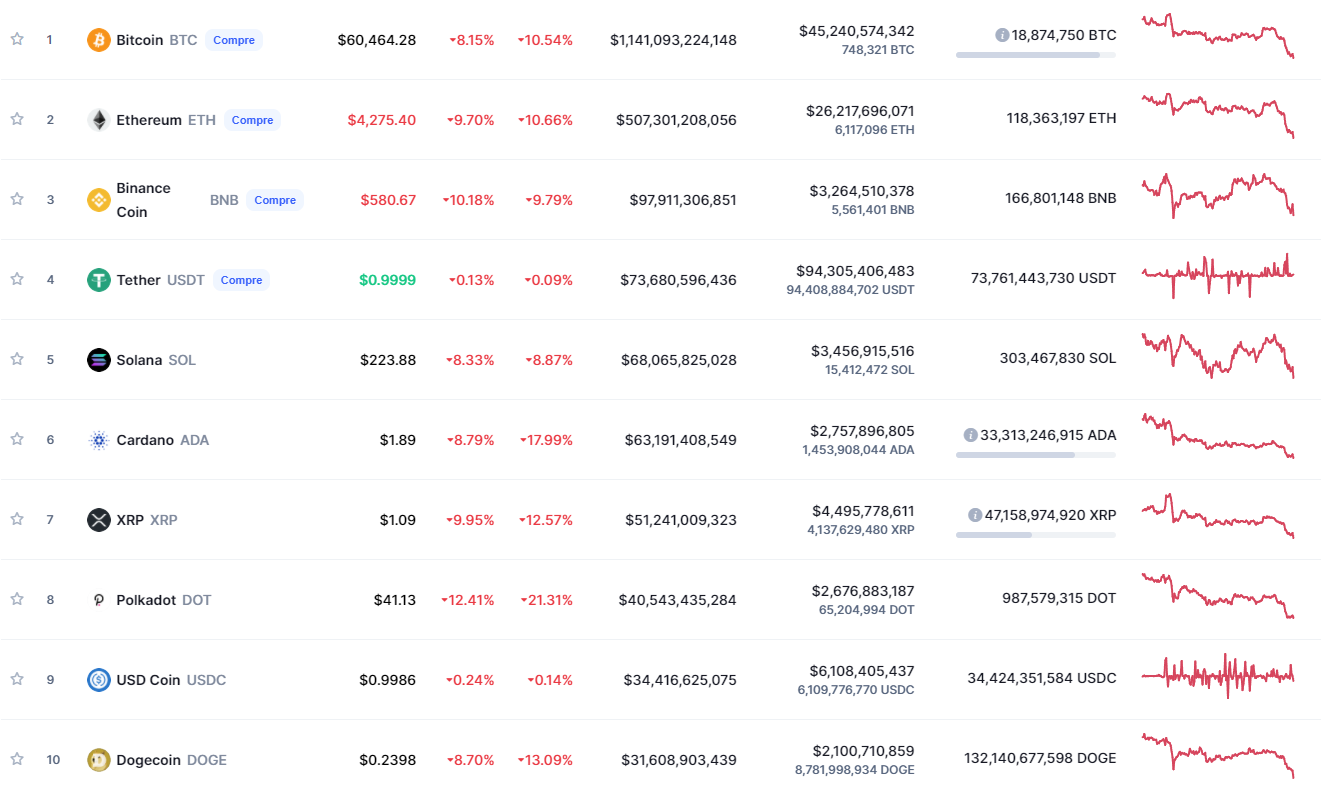

Tuesday (16) started with a sharp drop in the cryptocurrency market. Most of the larger-cap currencies fell sharply during the night.

Bitcoin, for example, dropped about 8% in 24 hours, returning to the price of $60,000. Around 7:00 am, Brasília time, the coin was sold for US$ 59,000. Recently, the BTC reached the ATH of US$ 69 thousand and has already accumulated a 114% increase this year alone.

Ethereum, the second largest currency by capitalization, was down 9% in 24 hours. The currency’s current price is $4,278. ETH has been trading higher recently, following the BTC’s bullish and bearish trends. The cryptocurrency has accumulated more than 50% increase in the last 6 months.

Solana also went into a slump this Tuesday morning. In just 24 hours, the currency dropped by nearly 8%. According to TradingView data, the current currency price is $224.

Among the other major cryptocurrencies, the crash scenario was not all that different. According to CoinMarketCap, among the top 10 in the market, the drop was more than 8%.

Coins such as Cardano, XRP, Polkadot, Binance Coin, Dogecoin and Shiba Inu dropped between 9% and 12% during the night.

US cryptocurrency regulation and pressure from China affect the market

For the first time since the 15th of October, the BTC reached levels below US$ 60 thousand. Other cryptocurrencies followed the downward trend, causing losses for some investors.

This scenario is a reflection of the infrastructure project sanctioned yesterday by the government of Joe Biden, in the United States. Among the rules is the regulation of cryptocurrencies.

Under the new law, digital asset transactions costing more than $10,000 must be reported to the Internal Revenue Service (IRS). The transaction recipient will need to verify the sender’s personal information within 15 days of the transaction. The new reporting requirement is scheduled to take effect in 2024.

Also on Monday night, cryptocurrencies received some more criticism from the Chinese government.

The National Development and Reform Commission plans to further crack down on industrial-scale Bitcoin mining, as well as any involvement of state-owned companies. China also announced that it would consider punitive measures, such as higher energy prices, on companies that break the rules.

Also Read: Gemini Announces Support for Shiba Inu Trades and Call for Robinhood Listing Grows

Read also: Cryptocurrency soars 100% after SpaceX launches new satellites

Also read: Trader Lark Davis points out 3 tokens that can increase 10x before the end of the year