Thursday (6) started with strong results and the return of the name of Eike Batista to the financial news. In the first aspect are Ambev (ABEV3) and petrochemical Braskem (BRKM5), which released their quarterly results.

The ex-billionaire and the richest man in Brazil has returned to the spotlight because of MMX. The mining company he founded in 2005 had its bankruptcy decreed by the Justice of Minas Gerais.

Ambev doubles profit in 1Q21

In the first quarter of 2021 (1Q21), Ambev’s results were very positive. The company was able to increase its revenue and reduce its expenses.

The company’s net revenue reached R $ 16.6 billion, an increase of 27% compared to 1Q20. The volume of beer sold grew 11.6%, while revenue per liter grew 14.5%.

In the comparison between quarters (1Q20 and 1Q21), the company’s revenue grew in all regions. The percentages recorded were as follows:

- Brazil: 26.1%;

- Central America and the Caribbean: 28.2%;

- Latin America: 44%;

- Canada: 1.6%.

Ambev’s EBITDA had an ambiguous performance. In absolute terms, it grew 25.9% and reached R $ 5.3 billion in 1Q21. However, the margin decreased from 33.1% to 32%. The reduction was due to the increase in production costs.

However, the company’s general debt decreased, from R $ 1.53 billion in 2020 to R $ 1.06 billion this year. As a result, the company’s profit reached R $ 2.7 billion in 1Q21, an increase of 124.9% in relation to 1Q20.

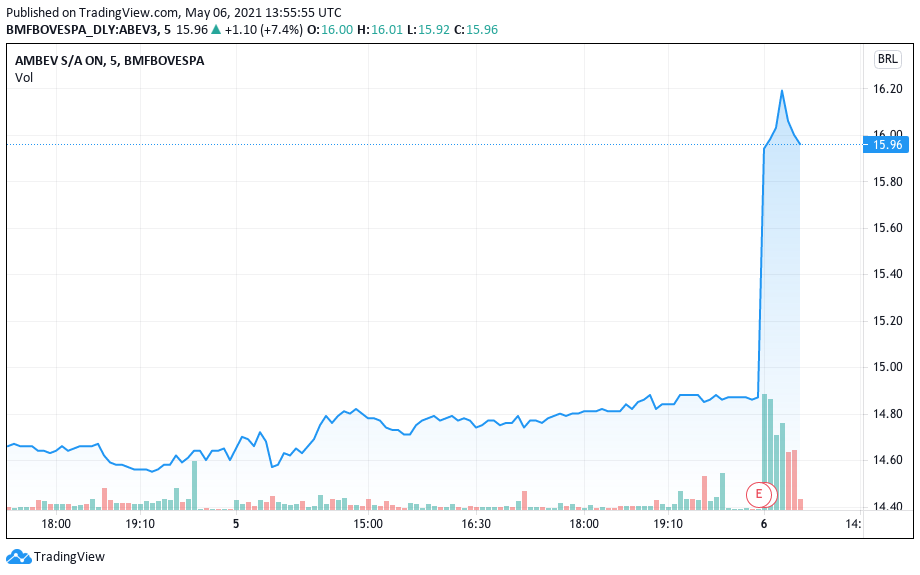

ABEV3 shares operate at a strong 7.4% increase in trading on Thursday (6), reaching R $ 15.96.

Braskem reverses loss

Braskem reversed a loss quarter and reached a net profit of R $ 2.49 billion in 1Q21. The growth was 195% in relation to the R $ 846 million registered in 4Q20.

The company’s operating result reached R $ 6.9 billion, an increase of 444% compared to 1Q20.

Part of the growth came from the depreciation of the dollar against the real, which benefited the company’s revenues. In addition to Brazil, Braskem has operations in Europe, Mexico and the United States.

The plants in these two regions, in fact, performed well. The company’s recurring operating result in dollars was 341% higher than in 1Q20.

As a result, free cash flow reached R $ 1.76 billion. But Braskem also points out that there were negative results.

“These positive impacts are offset, mainly by the negative change in working capital, mainly due to the impact of the increase in the price of resins and main chemicals on the international market in accounts receivable and the impact of the increase in the price of naphtha on the cost. of the finished product in inventories, ”said the company.

At this time, BRKM5 shares operate down 2.73%, quoted at R $ 50.69.

MMX is declared bankrupt

One of the pillars of the old “Império X” by Eike Batista, the mining company MMX had its bankruptcy decreed. The company confirmed the decision on Thursday morning (6).

According to MMX, the decision affects MMX Sudeste and was decreed by the 1st Business Court of the District of Belo Horizonte. MMX states that it was not officially stated in the decision, but that it intends to appeal in court if it is confirmed.

Created in 2005, MMX filed for bankruptcy in 2014. However, the Court stated that the company would not be complying with the proposed bankruptcy plan.

“Several times in the case file, the creditors and the Judicial Administrator reported that the obligations imposed by the PRJ and its amendment were not fulfilled, which, in itself, is enough to support the bankruptcy decree”, says the sentence.

Despite the negative news, the shares of MMX (MMXM3) operate at a strong increase in the trading session. The valuation is 16.82%, with the shares quoted at R $ 25.70.

Read also: Solana’s tokens could outperform the entire market in the coming months

Read also: Atlético Mineiro becomes NFT in “Cartola FC” in blockchain

Read also: Token values 2,000% in 7 days launching adult content NFT