The rise of Bitcoin (BTC) creates expectations of gains in investors. Seeking this high profitability, some of them operate with leveraged positions in futures contracts.

More experienced traders advise to manage risk and not to leverage beyond what is safe.

However, it seems that greed spoke louder. The recent sharp drop in BTC liquidated around R $ 4 billion in 6 different exchanges.

Mass settlement during Bitcoin low

Leverage is about leveraging an investor’s exposure. For example, an investment of R $ 100 with 10 times leverage can generate a gain of R $ 1,000.

However, for such leverage, it is necessary to take the R $ 1,000 into account. In case of loss, the trader can lose everything.

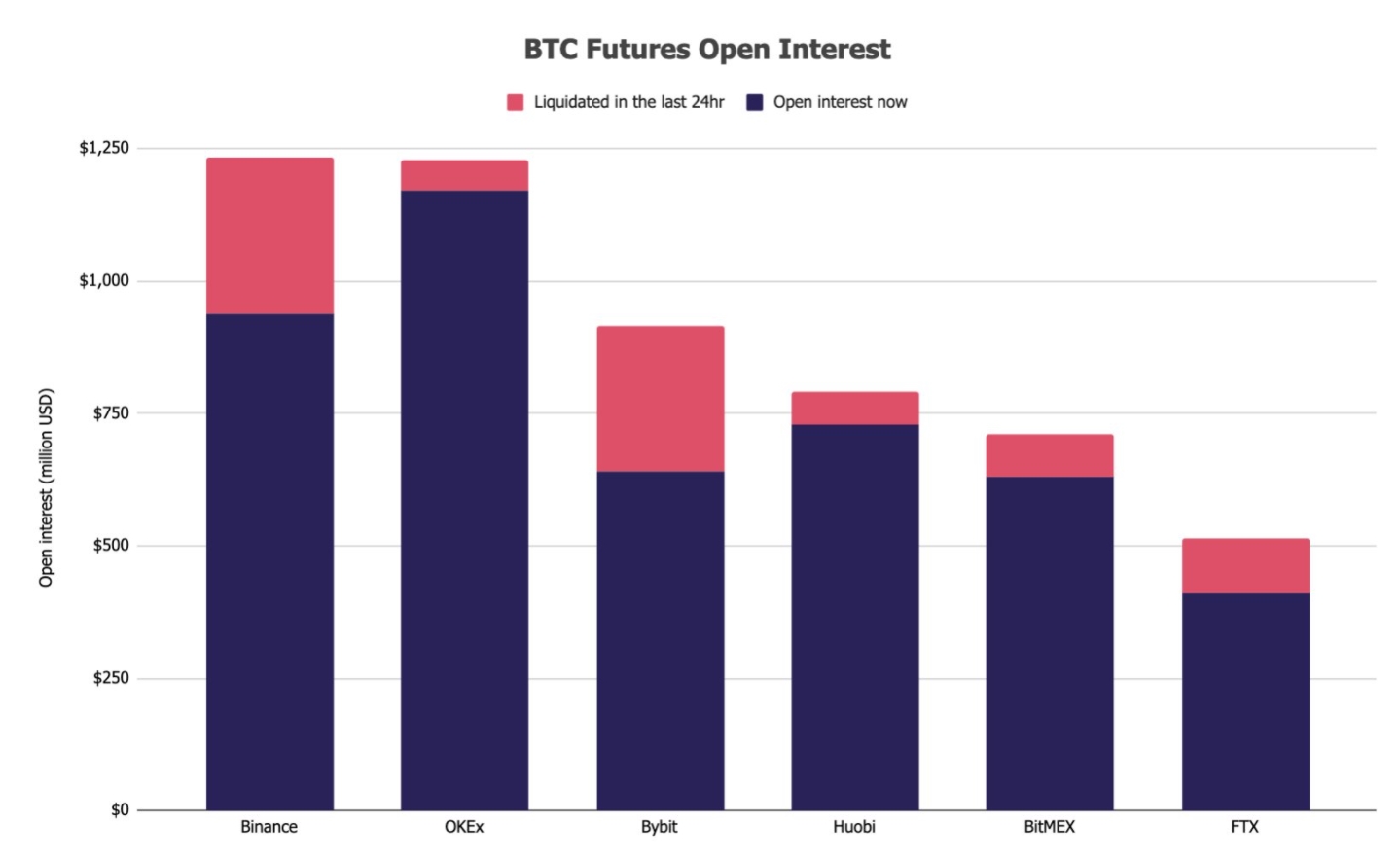

According to a chart displayed by Larry Cermak, a researcher at The Block, several positions have been liquidated:

Good visual representations of where most of the damage was done. Binance, Bybit and FTX all lost more than 20% of OI in the last 24 hours. This tells you that traders were really overleveraged on these exchanges pic.twitter.com/V2AyvJGdnk

– Larry Cermak (@lawmaster) November 26, 2020

“Good visual representations where most of the damage occurred. Binance, Bybit and FTX lost more than 20% of open interest [posições abertas de contratos futuros] in the last 24 hours. It says that traders were really over leveraged on these exchanges. ”

In graphic proportion, about US $ 750 million was lost between Wednesday (25) and Thursday (26). In reais, the value is close to R $ 4 billion.

Below, the image can be seen in its original size:

It is surprising that the settlement level at BitMEX is relatively low compared to FTX, Bybit and Binance.

This is because another major settlement episode, which occurred in 2020, was staged by the exchange.

BitMEX harms users

In March of this year, the event known as “Corona Crash” took place. This is the day that the world pandemic of Covid-19 was declared.

The financial market has collapsed, consequently damaging cryptocurrencies.

During the abrupt fall, BitMEX experienced a critical flaw in its system. Users, disgusted, went to Twitter en masse to criticize the exchange system.

In response, the exchange returned some 40 BTC to some users, not even close to the $ 10 million loss.

Also read: Analyst reveals how Bitcoin can rise again

Also read: Trader advises not to invest in Ethereum and XRP now

Also read: Warren Buffett plans secret investment: will it be in Bitcoin?