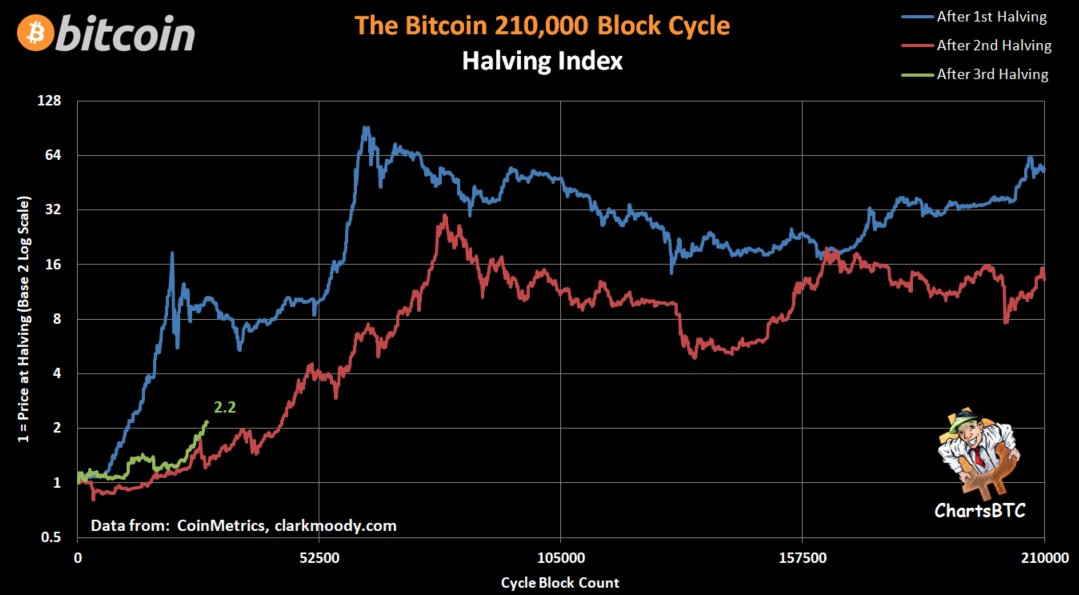

The evolution of Bitcoin’s price since halving is impressive. The price has more than doubled since the last cut in BTC issuance.

And Bitcoin’s appreciation has been greater than that seen after the last halving, which took place in 2016. The data was compiled by the analytics website ChartsBTC on Monday (23).

Compared to the previous two halvings, Bitcoin is on track to face new record highs.

Bitcoin price rises 120% since May

ChartsBTC compiled the data into a tool called Halving Index. He compares BTC’s progress in the six months following the halvings.

Thus, the index has historical data for 2012 and 2016.

The results show that, in terms of price action, Bitcoin is beating its race to the historic high.

The green line shows the evolution of the current post-halving period. Observe the intensity of the rise in the curve, at the moment much more intense than in 2016.

Only the 2012 halving produced a faster rise. However, Bitcoin was trading at just $ 12 at that time. However, months later, the crypto broke its first historic high – topping $ 1,000.

About 6 months after the 2020 halving, Bitcoin’s price is 2.2 times higher than at the time of the rewards cut. In 2016, the increase was 1.3 times, while 2012 produced a 12-fold increase in the same period.

New investor profile marks the current cycle

Halvings are often defined as Bitcoin cycles. And the current cycle has notable differences from previous hikes.

For example, the profile of buyers has changed. In previous cuts, most investors were Bitcoin enthusiasts, people with little capital to invest.

Now institutional investors have stepped in. Corporate giants, such as PayPal, satisfy customer demand.

In addition, great billionaires began to see value in BTC.

As a result, the term profile of investors has also changed. Large investors have a greater focus on the long term, not for speculation.

For the PlanB analyst, responsible for Bitcoin pricing models based on the “Stock to Flow” metric, this could lead to more price gains.

The analyst believes that January 2021 may mark the beginning of an appreciation cycle much faster. For him, Bitcoin could reach $ 100,000 still in 2021.

Read also: Bitcoin may triple in price with investment of 3 billionaires

Also read: Investor misses and pays R $ 250 thousand to move R $ 1,000 in Bitcoin

Also read: Peter Schiff strikes again: Bitcoin is not money, gold is